Morning All! As upsetting as the current affairs’ in South Africa are, we hope we can shed some light hearted updates from around the world. Its been fascinating week for the private equity markets. There are a lot of companies on a buying spree and changes are all around us, so lets jump into this weeks recap. Dont forget to give us a like❤️ and share with friends.

Cryptos are down this week, along with some of the major currencies, while the S&P 500 continues to push higher.

🔴Revolut Raises $800 million

Revolut raised a monster round from Softbank and Tiger Global that values the company at roughly $33 billion. To give you an idea, Deutche Banks current market cap is roughly $21 billion. The London-based financial “superapp” provides banking, investing, currency transfer and other money management services to some 16 million users globally

🌞Bad day in the Sun for J&J

Johnson & Johnson’s consumer arm just announced the recall of five aerosol sunscreens from its Neutrogena and Aveeno brands. J&J discovered traces of benzene (a cancer-causing substance) in its sunscreens. According to the CDC, long-term exposure to high-levels of benzene causes leukemia and other cancers. 😬 Read more here

🧊Iceland's shorter work week is complicated.

What really happened with the country's experiment. Despite the headlines, Iceland didn’t trial a four-day work week. Instead, the two trials reduced hours from 40 each week to 35 or 36. Some could choose to manage their remaining hours over four days, but this project was about understanding the impact of fewer hours, not specifically the idea of a four-day week. The key lesson to takeaway from the research, says Haraldsson, is that we unquestionably waste hours at work.

🎮Netflix Explores Gaming

Netflix’s growth is slooowing. 🐢 The Queen’s Gambit is great, but you can only watch it so many times and how else can you justify that monthly expense. Breaking into gaming is the next most logical step for Netflix 🔥 The company picked up a former EA and Facebook exec to lead the new vertical.

📈Grayscale Gets an Upgrade

Cryptocurrency asset manager Grayscale has been promoted… its Digital Large Cap Fund is now a reporting company to the SEC.🥂 Grayscale’s Digital Large Cap Fund includes Bitcoin, Ethereum, Litecoin, Bitcoin Cash, Chainlink, and Cardano. After becoming an SEC reporting company, the fund will file standard quarterly and annual reports (known as 10-Qs and 10-Ks) used by public companies. 🥳 The fund’s status update allows wealth investors to liquidate shares on the retail market after six months rather than twelve.

💎Blackstone on the move

Private equity firm Blackstone struck a deal to manage a huge portion of AIG’s $200B in assets. 🤑 Blackstone will start by managing $50B, increasing that number to $100B by 2027. Eventually, Blackstone will oversee about half of AIG’s retirement and life insurance assets. They dropped a further $6B to acquire Home Partners of America this month. Talk about money flush 💸

🎒Ahead of the pack.

Fitness company Peloton pays out more royalties to artists than many of the major music streaming platforms. According to The Trichordist’s “Streaming Price Bible,” which is based on 2019 measurements, Spotify offered music rights holders 0.35 cents per stream, while Apple Music paid 0.68 cents per stream, Tidal paid 0.88 cents per stream and YouTube paid 0.15 cents per stream. Peloton, on the other hand, paid a comparatively whopping 3.1 cents per stream.

🍄Mario!

An anonymous buyer purchased a 25-year-old Super Mario 64 game for $1.56M, a new record in video game sales.

FAIL!

THE COOLEST COOLER

The Kickstarter campaign raised $13m, shattering the crowdfunding site’s records. But is unexpected investment success a blessing or curse for startups? More here

JUICERO JUICER

The Internet couldn’t stop Laughing at This High-Tech Juicer

Engorged with $120 million in cash from top-shelf Silicon Valley venture-capital firms and declared the “coolest invention of 2016” by Goop, Juicero debuted last year, peddling pricey subscription bags of pre-chopped produce and a $700 contraption to crush them into juice. More here

THERANOS

And who can forget the biggest scam of them all. Theranos a printer-sized blood-testing machine that the company fraudulently claimed would diagnose a range of illnesses.

DID YOU KNOW?

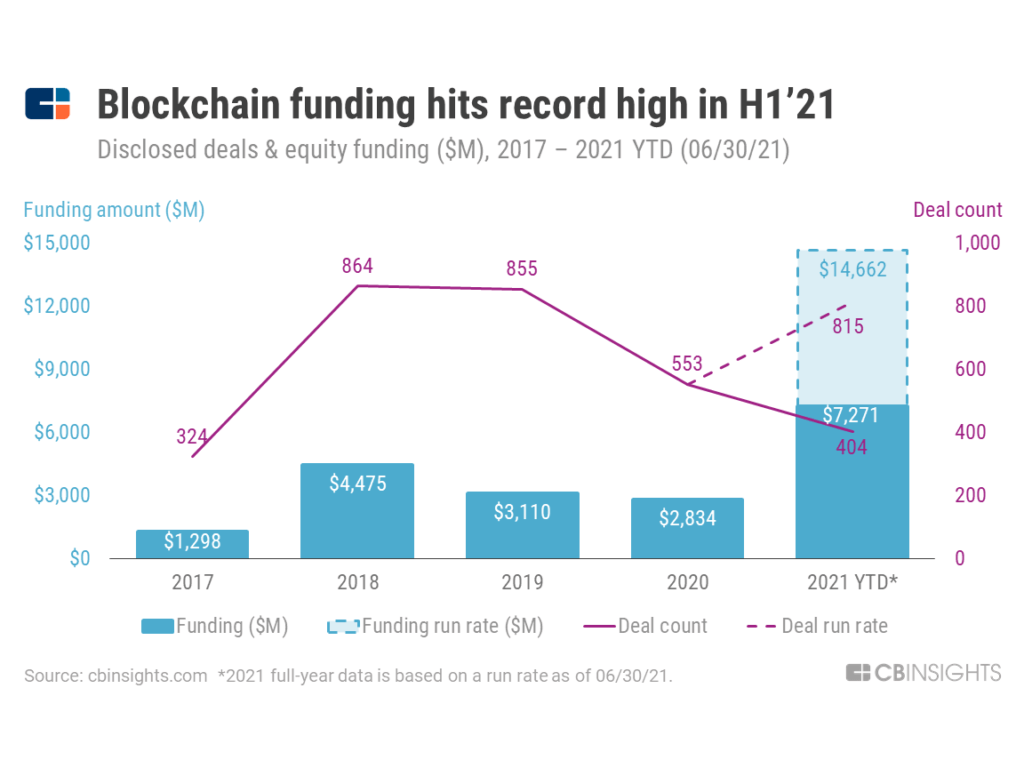

Blockchain companies raised over $7B in H1’21, breaking 2018’s full-year record of $4.5B raised.

Market drivers

Blockchain’s record funding year is being driven by the rising consumer and institutional demand for cryptocurrencies. Both groups are slowly starting to move the needle to help crypto and, therefore, blockchain become more mainstream.

Key drivers of blockchain funding include:

Consumer demand for crypto

Online exchanges like Binance, Coinbase, and Robinhood are breaking down barriers to entry, enabling consumers to start trading cryptocurrencies. Robinhood’s IPO filing stated that 17% of its Q1’21 total revenue came from crypto transactions — a figure over 4x that of the previous quarter.

Crypto trade volumes reached record highs at different points this year, and this was fueled by the continued boom in online brokerage activity.

Cryptocurrencies like bitcoin, ether, and dogecoin have all risen in value over the past 18

LINKS THAT DON’T SUCK

🌭 Hungry for change, Heinz petitions to make packs of hot dogs and buns come in equal quantities. Read here

📈 ETF inflows are highest they have ever been

🚀Jeff Bezo’s 10min in space

Cheers all I’m off to the bush for the weekend! I hope you all have a lekker weekend!